Mr. Powell’s article was taken from a Superior Farms newsletter. It’s in the Guide because it makes two important points.

- That the very high lamb prices of 2011 were actually counter-productive to the US lamb industry because they reduced lamb demand—which, in turn, resulted in the sharp drop in lamb prices in 2012.

- That recent articles by industry experts have inadvertently caused confusion on this key issue—because the authors (they are economists) definition of “lamb demand” differs from that of non-economists.

The above italicized type is our own—Premier.

“When the market is just going up, up, and up, we all tend to be blind to the holes in the market.” – Ron Clemons.

For those of us who make our living in the lamb industry the quote above is a painful reminder of where we have been. The unprecedented run up in prices is over. The wholesale market fell by at least 2% for four consecutive months. Slaughter lamb prices fell by over 8% in the first quarter of the year. Meanwhile, consumption continues to lag, even in the face of falling prices. Here is the bottom line—the strong market of the last two years has resulted in lamb being removed from menus, taken out of retail assortments, and, most importantly, halted the consumer momentum that the industry has worked so hard to attain.

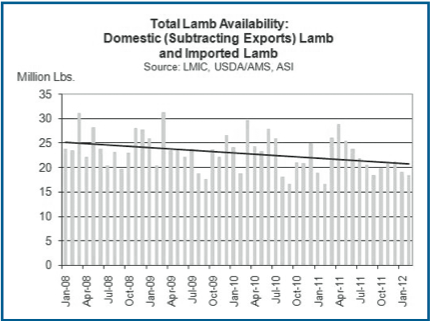

The evidence is compelling. In the last 52 weeks, Fresh Look data provided by the American Lamb Board shows that total category pounds decreased by almost 18%, while category dollars decreased by only 3% (on a year over year basis). The chart below is interesting because it provides a picture of total lamb availability in the United States (domestic and imported). As the chart demonstrates, total supply contracted in early 2012 to relatively low levels. In spite of lower supply, however, the market still weakened.

The final piece of evidence can be seen in the cold storage inventory numbers. As of March, cold storage inventory (as reported by the USDA) was over 20 million lbs. This represents a staggering 65% increase on a year over year basis. All of this data points to one obvious conclusion – consumer “pull through” has been negatively impacted.

I am concerned that this situation is not being clearly communicated to all of the industry’s stakeholders. Over the past month, I have read at least two industry publications that go out of their way to say that demand has not been destroyed. While I appreciate the academic distinction being made (demand denotes consumer preference for an item; the law of demand says that quantity consumed goes down as price goes up), I really question the underlying message. Make no mistake- consumers are purchasing less lamb in light of higher prices.

The difficulty of our current situation is not comprehended by the classic models covered in Economics 1A. In those simple, two-dimensional models, the market responds immediately to changes in price by altering consumption decisions. In the real world, the markets do not respond instantly. The lamb category has experienced both sides of this coin. When supply (both import and domestic) tightened in 2010–11 and prices shot up, retailers and food service operators faced practical obstacles to “passing through” those prices right away. As a result, consumption was not immediately impacted. Conversely, despite the first quarter pricing relief we have already described, consumption has not picked up.

It will take some time and persistence to invigorate the category. Clearly, this effort has already started. From our perspective, we see three key components:

- Cost—American lamb deserves a premium relative to import. The question is the size of that premium. History has shown that this premium must be in the range of 15–20% in order to attract retailers and food service operators.

- Features—Currently, we are seeing retailers willing to offer regular lamb features (discounts) for the first time in several months. Obviously, as pricing levels come off, retailers are willing to run features. Features attract shoppers to the category, create consumer trial, and increase overall consumption.

- Consumers—The average lamb consumer spends 40–60% more than the non-lamb consumer. Retailers and restaurant operators covet the lamb customer as a highly desirable (ie. profitable) target. As an industry, we have to continually point out to our customers that lamb on the menu or on the shelf represents the opportunity to attract and serve these “high value” targets.

By Craig Powell, Superior Farms